Award-winning PDF software

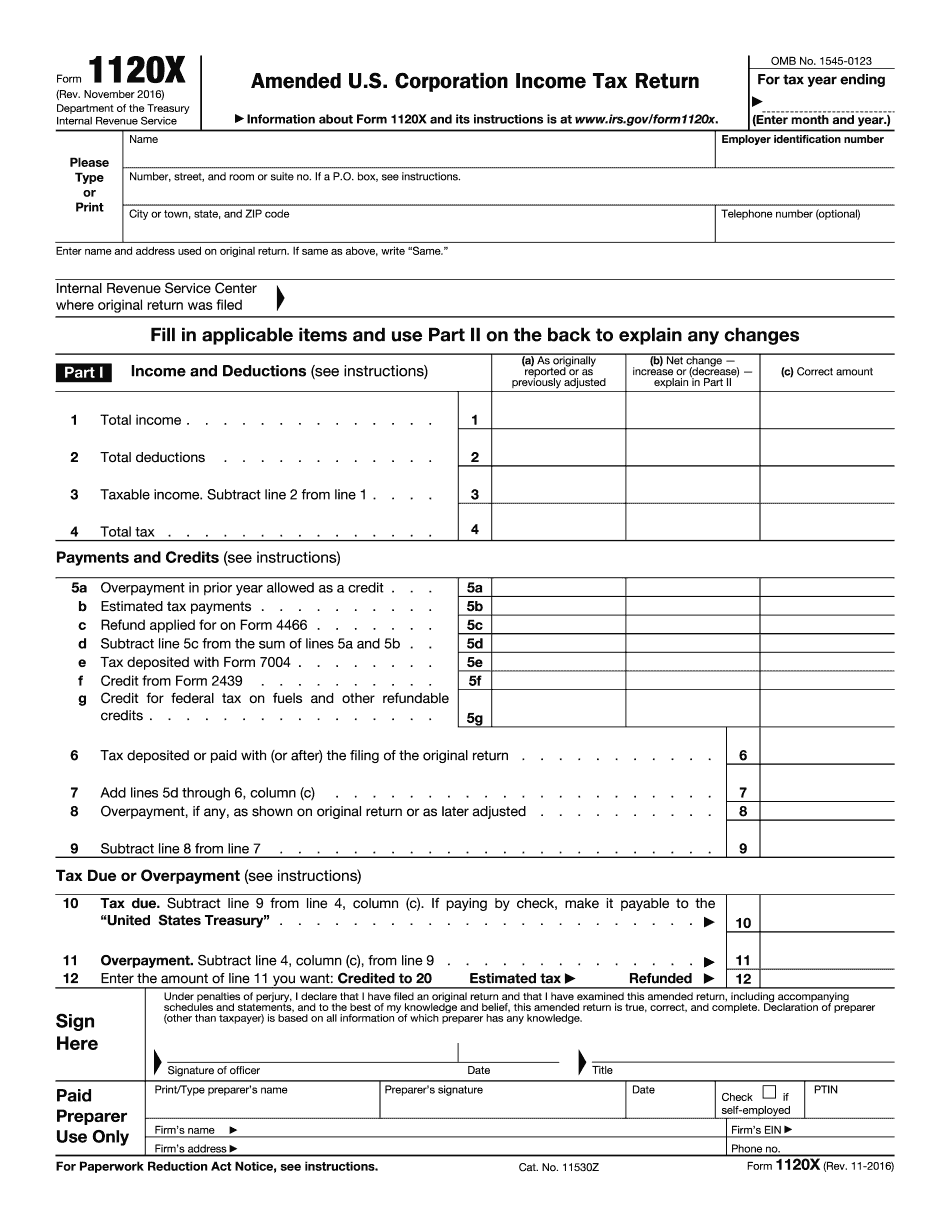

Form 1120-X online Fargo North Dakota: What You Should Know

Proposed Collection: Notice of Federal Tax Lien on Property Subject to Tax under the Code Sep 01, 2025 — The IRS is soliciting comments on the imposition of a federal tax lien that may be attached to a property when: (1) the sale, exchange, or other disposition of the property to a person or persons who do not appear on the tax return is not reported pursuant to IRS procedures; or (2) the taxpayer has failed to file a tax return with the IRS for the reporting year for which the property is subject to taxation, or an election to have the tax not be reported. The notice shall set forth the property and whether the tax liens may be imposed. The notice shall state that if the notice is timely filed, the owner or occupant may file an appeal. If the notice is not timely filed upon service of the notice of federal tax lien on property, no tax liens may be imposed under this subsection and no appeal is available unless, within ten days from the service of the notice of federal tax lien, the tax lien is properly filed. However, if there is a failure by the taxpayer to file an election to have the tax not be reported, tax lien may not be imposed pursuant to this subsection for any year following a return year. The notice shall be sent by certified or registered mail to the owner or occupant (as applicable) at the address of record with the Department of the Treasury for the applicable year that is, unless that address has been deleted from the return, as applicable. If a notice is returned undeliverable or if the applicable year is terminated, the lien may not be imposed as of the time the notice was returned undeliverable or, if the applicable year has not ended at that time, the lien may not be imposed until the property is sold or otherwise disposed of. The notice shall be mailed on Form 1065, Statement of Tax Liens. The notice must be mailed to the owner or occupant at the address of record with the Department of the Treasury for the applicable year that is, unless that address has been deleted from the return, as applicable. Tax liens may not be imposed for any year pursuant to this subsection if the owner or occupant has not timely paid all tax due for that year. Comments: If the notice is timely filed and a judgment is entered against the taxpayer, the lien shall be imposed within the period of limitation provided in Section 6113 of the Internal Revenue Code.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1120-X online Fargo North Dakota, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1120-X online Fargo North Dakota?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1120-X online Fargo North Dakota aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1120-X online Fargo North Dakota from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.