Award-winning PDF software

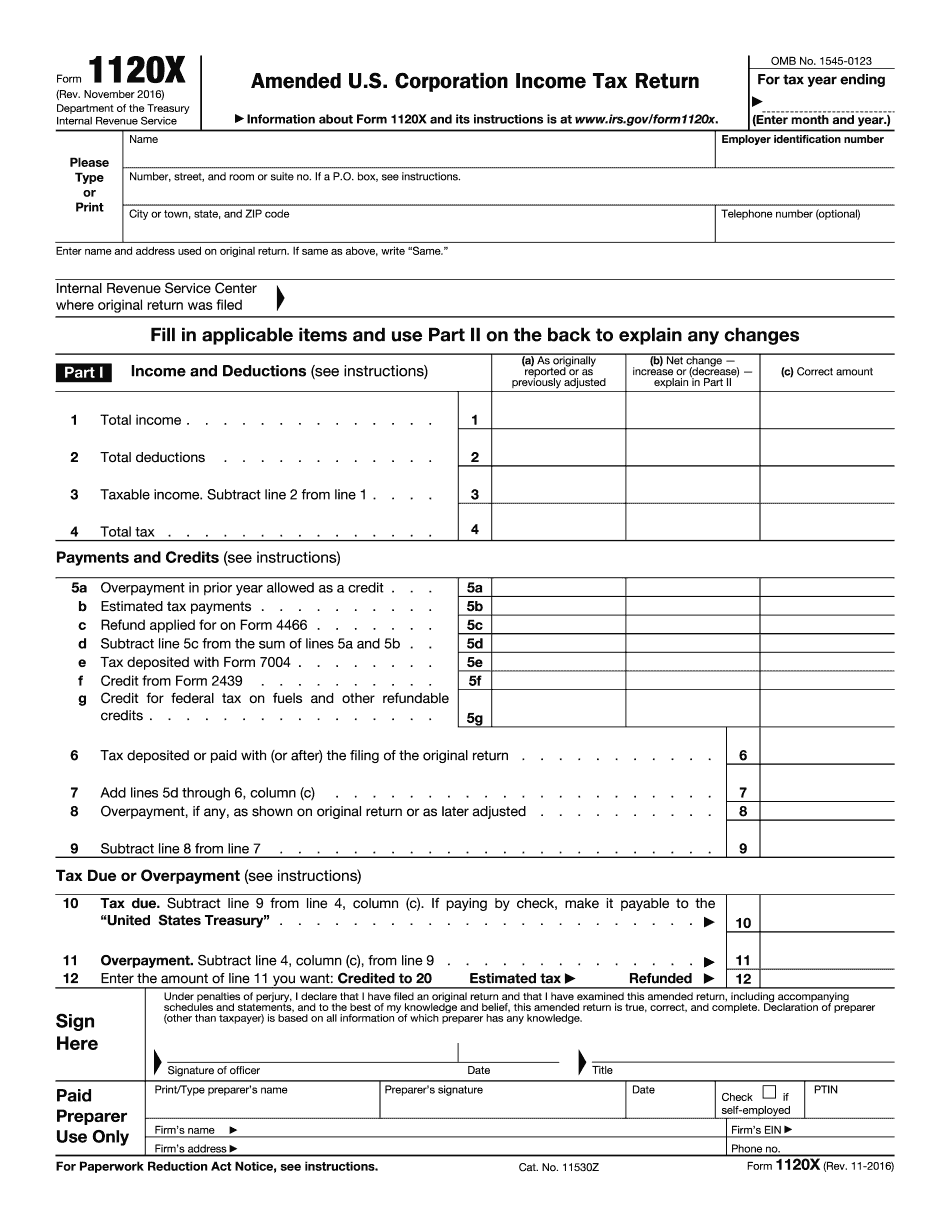

Joliet Illinois online Form 1120-X: What You Should Know

The City's Tax Portal can be accessed by going here, or by calling from 8:00 a.m. to 5:00 p.m. Monday through Saturday. Taxes not paid on time to the City's Tax Portal, or for any other reason, or if they were due on time but have been paid late or are overdue, are subject to a late/arrears payment fee of 100.00. For more information and to have a refund request processed, call. Taxes paid for more than 14 days past due (excluding collection fees and penalties) will not be refunded. However, an interest-free payment plan is available through the City of Joliet. When submitting your Payment Plan Request, you should submit your tax payment, the Payment Plan amount and the amount due based on interest rates shown. Payment must be made to the City of Joliet Tax Collector within seven (7) days of receiving the Tax Master Form Number shown for this form. Tax Forms for each taxing individual will need to be submitted and approved at the time of application for the plan. For more information on the Tax Master Form Numbers, refer to Forms 1120-X, and to our Tax Master Form Number information. Please note that if your filing status is listed as “not reported,” you must file your taxes for all years in the federal taxable year with no withholding, and you must pay no more than your tax liability which includes current and prior tax years. If you receive a check for more than 5.00 during the federal tax year, write it to the United States of America. The City of Joliet is not responsible for the payment of the tax to the IRS. Please take care to ensure that all required payments are made to the appropriate account and the correct name is on the check. If you don't write a check to a U.S. Social Security, veterans, or postal account, a U.S. Taxpayer Identification Number (SIN) will not be assigned to your payment. If you need additional assistance in completing Form I-400, payment is not required. The amount to be paid must have a dollar amount not greater than 5000.00. The amount is to be paid directly to the United States Government. Payment should be in cash, or a check for 5000.00 that is payable to the United States of America and include the original signature of a U.S. official.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Joliet Illinois online Form 1120-X, keep away from glitches and furnish it inside a timely method:

How to complete a Joliet Illinois online Form 1120-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Joliet Illinois online Form 1120-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Joliet Illinois online Form 1120-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.