Award-winning PDF software

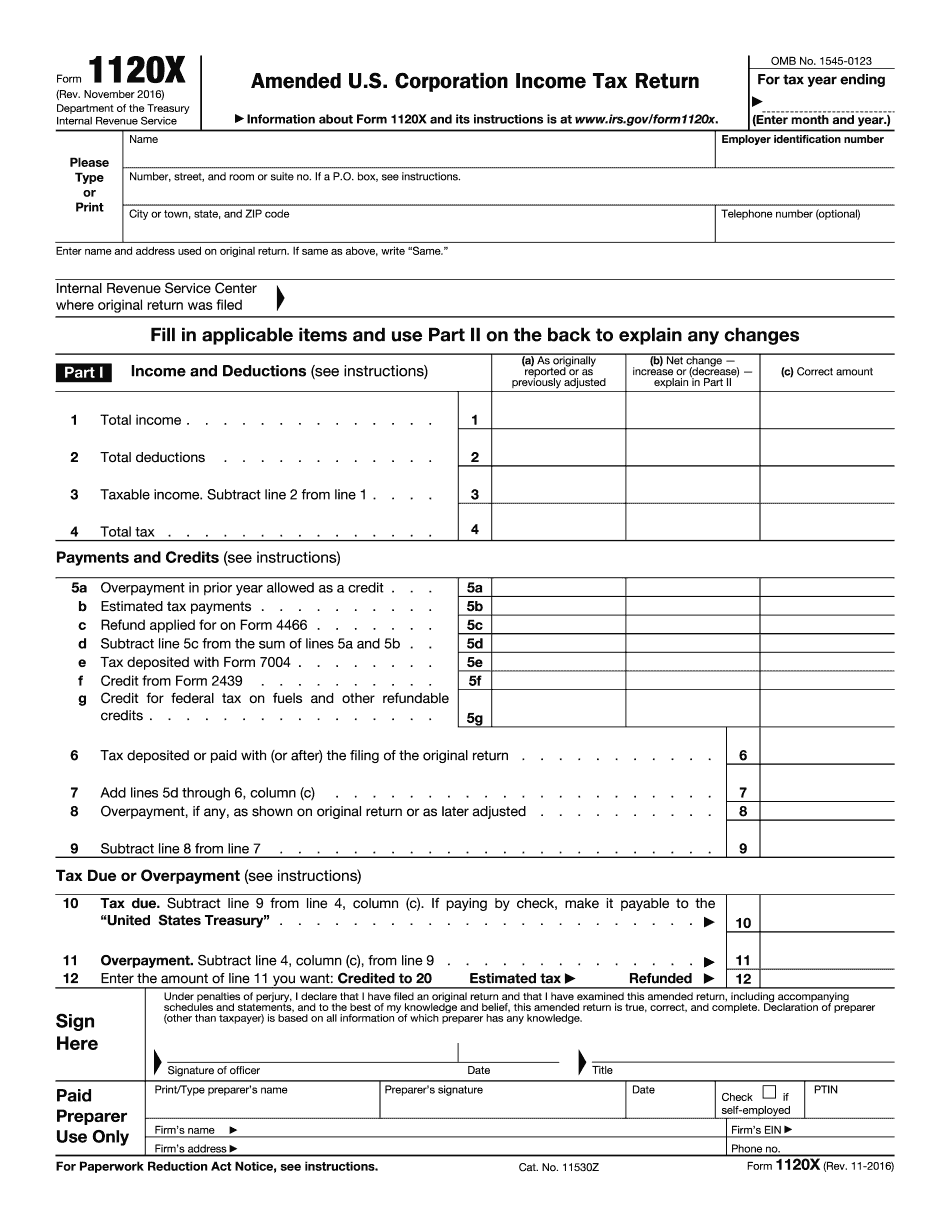

Salinas California Form 1120-X: What You Should Know

M. To 5 p.m. · The Abandoned Vehicle Office is located at 1324 E. Mission Ave. Salinas, CA 94589 You may also use our automated filing service at, a taxpayer service provider to the City of Salinas. Payment for your tax return in compliance or non-conforming forms: Pay the return on its due date: (You can request an administrative review form or submit your payment by electronic funds transfer). The payment by electronic funds transfer may be a faster way than mailing back the amount. Your payment must show the amount owed as of the current date or later than the due date. The City of Salinas is not responsible for any taxes not paid during the due dates, so please be sure that your payments are accurate. If you paid tax using other means or for a year other than currently scheduled; contact the Customer Service Center, to amend your payment. You may also mail in the payment. Payment by Check: Please make each payment on the payment card/bank account that you used to pay the Tax. Payment by Credit/Debit Card: You may use this payment option for your tax order. You will be asked to type in your personal, social security or business number upon receipt and to make a note of the number (the number must be entered on the credit or debit card/bank account that you used to authorize payment) on Schedule A. Credit cards may be used for payment of your municipal tax bill only if there is an item in the check/money order amount to cover the balance of the amount due. It is your responsibility to notify the City when you have made a payment and the City has been notified. A check is not acceptable as payment for any municipal tax bill. If you have questions or concerns, call. You may also contact the City's Customer Service Center by calling 9-1-1 or by contacting the City's Parking Bureau at. Information on the County Tax Collector's website. Failing to Report Vehicle Ownership You must report your vehicle ownership information (VIN) on form RC16-11 within 30 days of acquiring it. Contact the County Clerk's office at for more information. For more information, you can review the Vehicle Record Form (PDF).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Salinas California Form 1120-X, keep away from glitches and furnish it inside a timely method:

How to complete a Salinas California Form 1120-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Salinas California Form 1120-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Salinas California Form 1120-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.